Algorithms developed by E6X

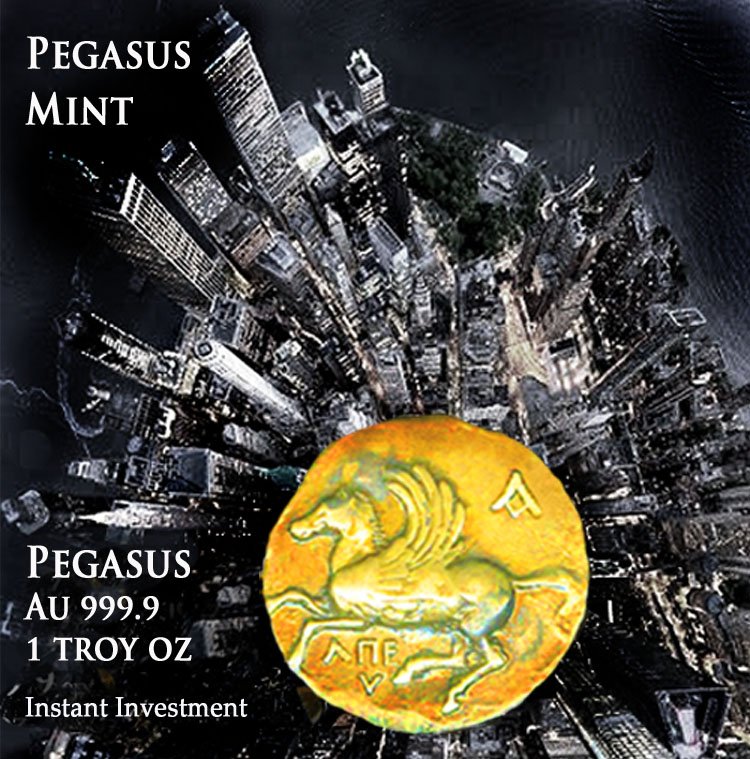

pegasusGOLDcoin

Pegasus Gold Coin – investment fund gold refinancing

Algorithms developed by Q5D

quantAI

Matrix X – investment fund for solar smart city general project investment

NEW Heliopolis – Generation 5+ solar smart city

Gold Food Coin

Au 999.9 for Matrix X Investment Fund adjusted to Gold Refinancing tools

Apply in advance please

ONE TROY OUNCE

31.103 Gramm

Matrix X

Investment Fund

Pegasus Gold – investment in solar smart cities Generation 5+

10 Troy Ounces

COIN Au 999.9

Number of Gold Coins / from 10 gr

1 OUNCE = 31.103 gr / to 10 OZ = 311.03 gr

Investment Algorithms for Element 6X Group Clients

gold refinancing through the digital platform of Elelment 6X Group. Investment in sustainable projects is most suitable usinge E6X algorithms.

ALGORITHM

Investment Vertical Fund

pegasus gold MINT 5(Δ)

AAlgorithms

5D

DIGITAL PLATFORM

10+

ALGORITHMS

GENERATION 5+

SOLAR SMART CITY

algorithm Matrix X 5(Δ)

Matrix X – monochrome vertical investment Algorithm “Matrix X” – secure investment in gold coins with % enough to cover two months increase of gold price based on 6months spot prices. Additional 2.25% dividends incorporated in the Algorithm come from investment in solar energy and energy storage for smart city Generation 5+

READ MORE

algorithm 5Dclouds

algorithm 5Dclouds

Digital platform for 5d clouds & data centre – 5d clouds is a module in solar smart city generation 5+ / modular system based on solar energy and latest technologies for energy storage / 5d solar banking : quantum 5d solar bank – digital currency of solar smart city projects – with investment coins – transaction coins – education coin based on one quantai equivalent / reward instrument

READ MORE

algorithm newbabylon

algorithm newbabylon

solar smart city generation 5 +BioDiversity = “NEWbabylon” edition 6.0 developed with participation of several partners. master plan prepared in two version according potential interests of investors in the project. NEWbabylon combines latest technologies for smart cities: state of art cloud & data center. area of the project 50/85 ha with dencity 0.25 and green area 40%. project integrate biodiversity concept which bring concept much higher to compare with Generation 5+.

Animated Heading

new way of investment and reinvestment in gold

Algorithms matching all requirements of United Nations Sustainable Development Goals

LTV by E6X

REFINANCING ALGORITHM LTV

LTV (loan-to-value) services for investment gold refinancing: the present market actually looks like there today, realistic LTV/fee ranges, the legal/AML picture, practical routes you can take, a various samples of LTV calculation, and an e-mail/RFP template you can send to Element 6X.

Algorithms for Gold Refinancing

Most large EU banks don’t publish LTVs for physical gold; lending against gold in EU (private lenders, dealers or foreign banks using an external vault).

true financial institutions institutional LTVs (50–80%) are primarily available from specialist providers — Switzerland or Liechtenstein) or from private banks.

E6X recommends route for higher LTV

Element 6X Group is arranging LTV through boutique lenders willing to take physical LBMA bars in approved custody.

Using international programs: 50%–80% LTV for allocated LBMA Good Delivery bars stored in a Swiss/Luxembourg vault and financed by specialist lenders. Higher LTVs (70–80%) are possible but typically for top counterparties and with strict terms (allocated bars, insurance, immediate liquidation rights.

Investment Gold digital platform for investment in sustainable energy and in solar smart cities. Investment through Gold Refinancing and Pegasus Gold Coin.

Typical fees & service charges

(estimates)

Storage / vault fee: 0.33% [Range 0.2%–1.0% p.a. of metal value (Swiss vaults commonly 0.2–0.6%; local/private vaults can be higher)].

Insurance: Often included or charged as part of vault fee; if separate, expect 0.05%–0.2% p.a. depending on coverage.

Refining: 0.35% [range / assay / conversion fees: one-off costs when you need bars verified/refined, In EU €10–€50 per kilo for basic assay/handling or higher if full refinery work necessary (depends on refiner].

Loan interest: 3%-4% [Institutional Lombard-style loans via banks or specialists typically have annual rates in the single digits to low double digits depending on credit profile, size and tenor].

Origination & legal fees: Expect fixed legal / documentation fees if the bank insists on a pledge agreement, lien registration or custody tri-party (one-off, a few hundred to a few thousand EUR according to complexity).

Request PDF with full description from E6X

Loan-to-Value Algorithm of the Matrix X Fund

Cross-Border Custody

Cross-border custody: If you plan to store gold abroad (e.g., Zurich) and use it as collateral, verify cross-border transport/customs documentation and any export/import reporting. If customers ask Element 6X to arrange storage and custody destinations and destination country can offer storage/forwarding services — ask for documented chain of custody.

Documentation checklist

1. Proof of ownership (invoice, chain of custody).

2. Bar certificates / serial numbers / refiner assay (LBMA Good Delivery documentation if available).

3. ID and full KYC / beneficial-owner documentation.

4. Proposed custody arrangement (vault address, insurance).

5. Requested loan amount, tenor, and intended use.

6. Consent to pledge/pledge agreement / custody agreement signatures.

LETTER FORM TO APPLY FOR LTV REFINANCING

GET LETTER FORM of Land-to-Value Element 6X